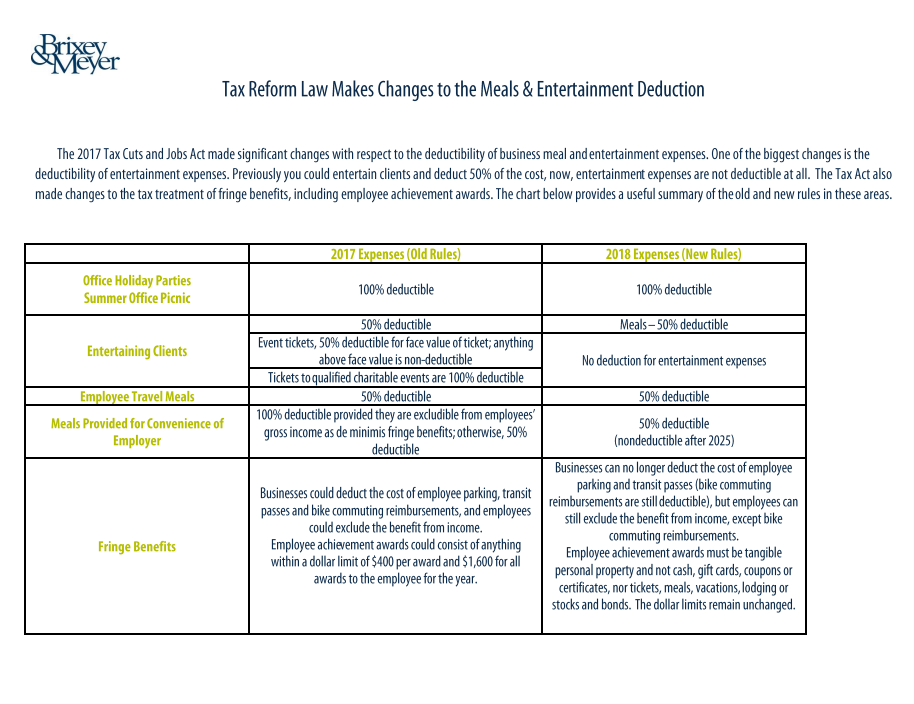

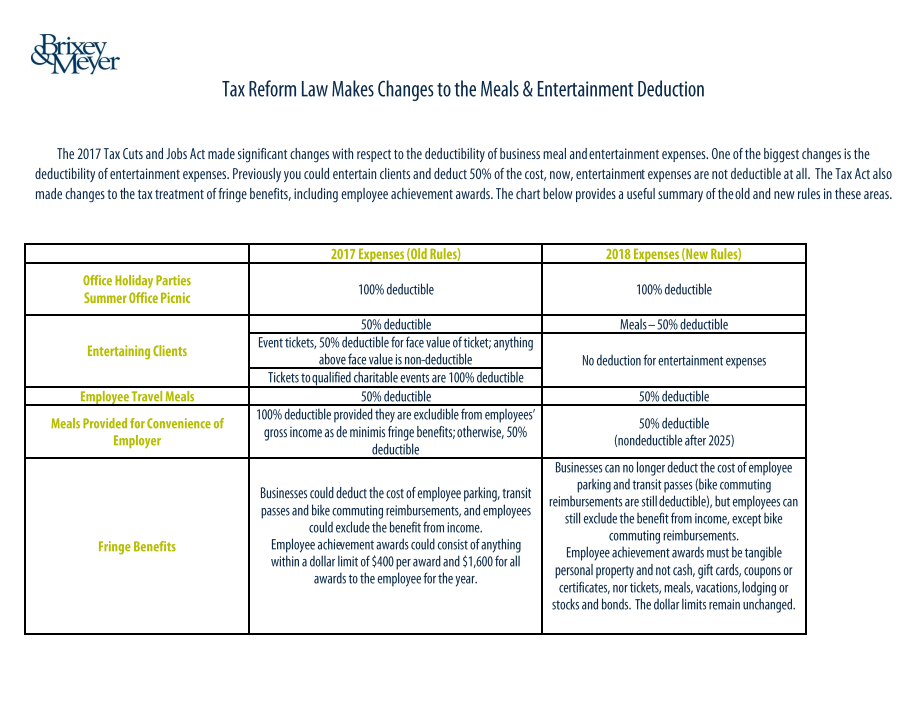

Tax Reform Law Makes Changes to the Meals & Entertainment Deduction

The 2017 Tax Cuts and Jobs Act made significant changes with respect to the deductibility of business meal and entertainment expenses. One of the biggest changes is the deductibility of entertainment expenses.

Previously you could entertain clients and deduct 50% of the cost, now, entertainment expenses are not deductible at all. There is some question as to the deductibility of meals to the extent that they may fall under that entertainment umbrella. Hopefully, further guidance will be forthcoming, but we are advising our clients to continue to keep track of their business-related meal expenses in the hope that these will still be deductible as long as there is no entertainment component to the meal. With respect to meals provided for the convenience of the employer and considered to be a de minimis fringe benefit, deductibility has gone from 100% to 50% and after the year 2025 will be nondeductible. The Tax Act also made changes to the tax treatment of fringe benefits, including employee achievement awards.

Check out a downloadable chart below that provides a useful summary of the old and new rules in these areas.

Feel free to reach out if you have specific questions with regards to this blog.