Tax Update: Decrease in Income Tax Rates & Repeal on Sales Tax for Staffing Services

Published by

Jeff Kujawa

on

Tax Rate Update

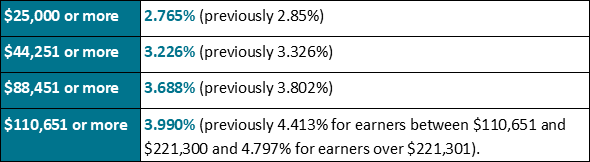

Ohio individuals will experience a tax rate decrease that is retroactive to January 1, 2021. See the below chart for the income tax rate changes for all earners:

The business income deduction is still applicable for business owners where the first $250,000 of business income is exempt from Ohio tax. Business income above $250,000 is subject to a 3% tax rate.

Sales Tax Update

Effective October 1, 2021, Ohio repealed the sales tax on staffing services in an effort to increase employment and wages while saving Ohio businesses $300M annually.

If you would like to discuss these changes with one of our tax experts, Start The Conversation on our website!