2021 Cost of Living Adjustments

Get prepared for 2021! Check out the cost of living adjustments and see how you will be affected.

New IRA Income Eligibility Rate for 2021

Income Phase-Out Ranges determine Eligibility to make deductible contributions to Traditional IRA accounts:

Traditional IRA phase-out ranges

- $66,000 to $76,000 - Single taxpayers covered by workplace retirement plan.

- $105,000 to $125,000 - Married Couples Filing Jointly. This applies when the spouse making the IRA contribution is covered by a workplace retirement plan.

- $198,000 to $208,000 – A taxpayer not covered by a workplace retirement plan married to someone who is covered

- $0 to $10,000 - Married Filing Separately

Income Phase-Out Ranges for Taxpayers making contributions to a Roth IRA accounts:

- $125,000 to $140,000 - Single taxpayers and Heads of Household

- $198,000 to $208,000 - Married Couples Filing Jointly

- $0 to $10,000 - Married Filing Separately

Income limits for Saver's Credit, also called Retirement Savings Contributions Credit

- $66,000 – Married, filing jointly.

- $49,500 – Head of household.

- $33,000 – Singles and married individuals filing separately

Education and Child-Related Breaks

The American Opportunity Credit- Phase out ranges for this education (maximum $2,500 per eligible student) remain the same for 2021: $160,000 - $180,000 for joint filers and $80,000 - $90,000 for all other filers

The Lifetime Learning Credit - The phaseout ranges for this education credit (maximum $2,000 per tax return) increase for 2021. They are $119,000-$139,000 for joint filers and $59,000-$69,000 for other filers — up $1,000 for joint filers, but the same as 2020 for others

The adoption credit - The phaseout ranges for eligible taxpayers adopting a child will also increase for 2021 — by $2,140 to $216,660-$256,660 for joint, head-of-household and single filers. The maximum credit increases by $140, to $14,440 for 2021.

Gift and Estate Taxes

The unified gift and estate tax exemption and the generation-skipping transfer (GST) tax exemption are both adjusted annually for inflation. For 2021, the amount is $11.7 million (up from $11.58 million for 2020).

The annual gift tax exclusion remains at $15,000 for 2021. It is adjusted only in $1,000 increments, so it typically increases only every few years. (It increased to $15,000 in 2018.)

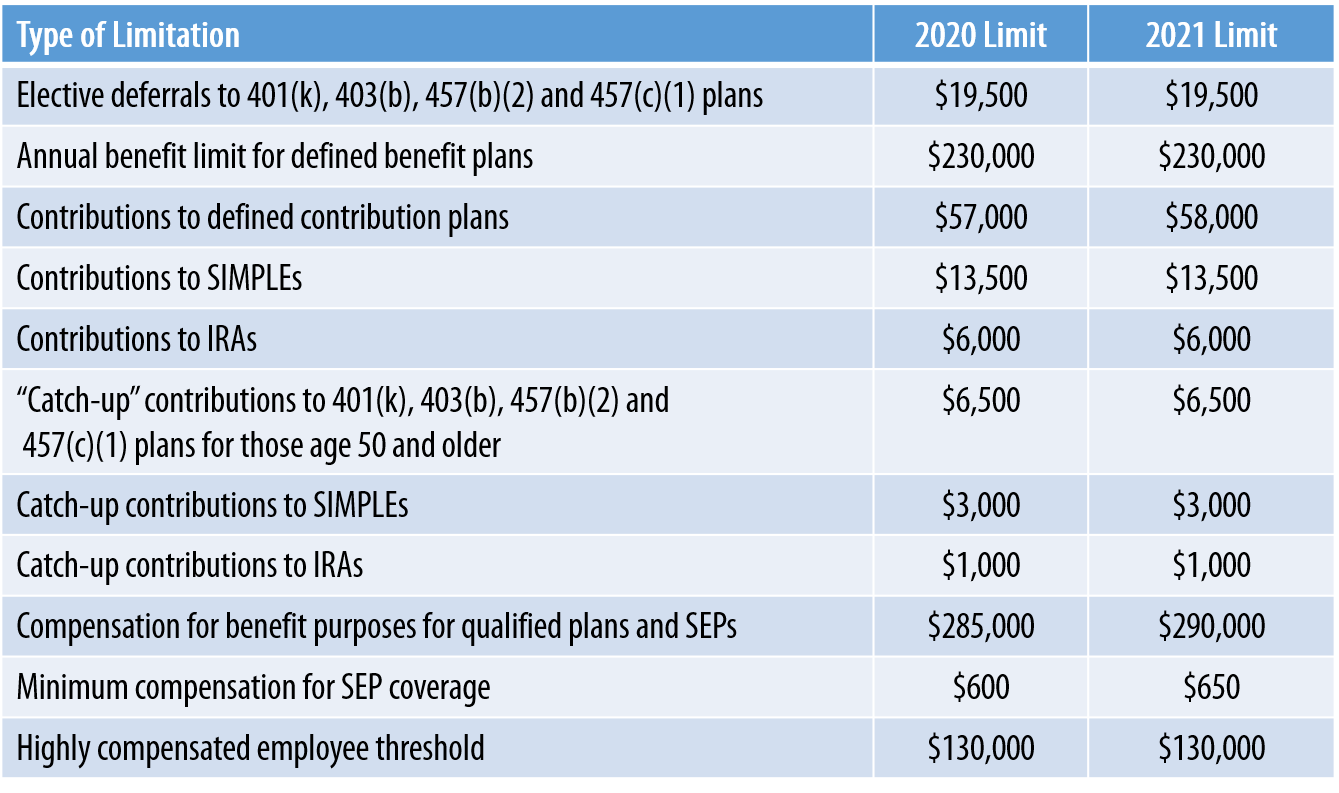

Retirement Plans

Not all of the retirement-plan-related limits increase for 2021. Thus, you may have limited opportunities to increase your retirement savings if you have already been contributing the maximum amount allowed:

Please feel free to reach out to Brixey & Meyer to help navigate 2021. You can simply comment below, visit our website or call us at 866.760.0940.